|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

Understanding Chapter 7 Bankruptcy in Denver: An Introduction

Filing for Chapter 7 bankruptcy in Denver can be a significant decision with long-term effects. It is essential to understand the process, its implications, and how it can provide relief from overwhelming debt.

What is Chapter 7 Bankruptcy?

Chapter 7 bankruptcy is often referred to as 'liquidation bankruptcy.' It involves the sale of a debtor's non-exempt assets by a trustee, with the proceeds distributed to creditors. In many cases, the debtor may be able to keep essential property and is discharged from personal liability for most debts.

The Process of Filing

- Eligibility: Not everyone qualifies for Chapter 7. The means test compares your income to the median income in Colorado to determine eligibility.

- Filing: The process begins with filing a petition with the bankruptcy court. This includes detailed information about your finances, income, debts, and assets.

- Automatic Stay: Filing initiates an automatic stay, stopping most collection actions against you.

- Trustee Involvement: A trustee is appointed to oversee your case, evaluate assets, and determine exemptions.

- Discharge: Successful completion of the process results in the discharge of qualifying debts.

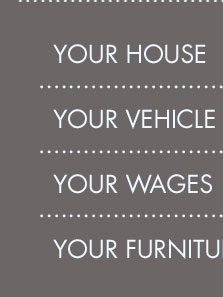

Exemptions in Colorado

Colorado allows certain exemptions, enabling you to keep specific assets. These include:

- Homestead exemption: Protects equity in your home.

- Vehicle exemption: Covers equity in your vehicle.

- Personal property: Includes clothing, household goods, and other essentials.

- Wages: Protects a portion of earned but unpaid wages.

Understanding these exemptions can be complex, and consulting with a bankruptcy attorney indianapolis can provide clarity on retaining your assets.

Benefits and Risks

Filing for Chapter 7 bankruptcy offers several benefits:

- Immediate relief from creditors.

- Discharge of unsecured debts like credit cards and medical bills.

- A fresh financial start.

However, there are risks involved, including:

- Loss of non-exempt property.

- Negative impact on credit score.

- Potential difficulty in obtaining loans or credit in the future.

Alternatives to Chapter 7

Before filing, consider alternatives such as debt consolidation or negotiating with creditors. Chapter 13 bankruptcy might also be an option, where you can keep your assets and pay debts over time.

Frequently Asked Questions

For more specific guidance, consulting a bankruptcy attorney jacksonville fl or a local expert can be invaluable in navigating the complexities of Chapter 7 bankruptcy in Denver.

Chapter 7 Fee Waivers - Register of Mailing Addresses of Federal and State ...

Chapter 7 is open to most individuals and businesses that haven't filed a previous bankruptcy in the past 6 8 years.

Chapter 7 Bankruptcy Lawyer in Denver. Serving Jefferson County, Douglas County, Arapahoe County, and Adams County.

![]()